Tax Filing Made eezy for UK Residents and Non-Residents

Trustworthy

- Trusted by Thousands - Over 20,000 returns filed successfully

- HMRC Approved - Fully compliant and recognised by HMRC

- Making Tax Digital Ready - Fully compliant with HMRC’s MTD requirements.

- Your Data, Protected — Bank-level encryption for total peace of mind.

- Highly rated on Google and TrustPilot .

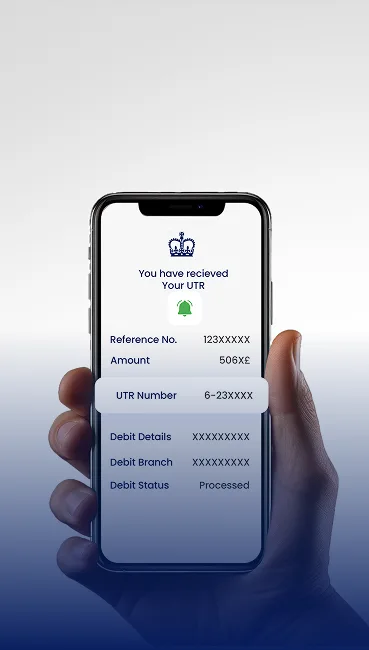

- Fast & Accurate - Tax Return Turnaround in 3 Working Days.

0%

Referral Rate

0%

Data Security

HMRC

Accredited Accountants

In-House

Tax Specialists

0 Days

Year-Round Support

0+

Tax Returns Filed for Clients in the UK and Abroad

Today's Signups50+

How We Work

Simple, transparent, and stress-free

Procedure

Code Of Conduct

Data Security

We keep your personal and financial information secure at every step — safe, confidential, and never shared without your consent.

Transparency

We keep you informed every step of the way — no hidden fees, no surprises, just complete transparency.

Client's Approval

We always get your approval before submitting any tax return or taking action, ensuring accuracy, control, and peace of mind.

Code Of Conduct

Designed for you

Not Your Accountants

Market Comparison

Why don’t we simply compare basics for starters

| Price Premium service at an unbeatable price. Expert-led tax filing and year-round support for only £130. |

£130 per annum | £169 per annum | Free Software |

| In-House Dedicated Tax Specialist Get a dedicated professional who knows your financials inside and out. |

|||

| Expert Advice Personalised guidance from our experienced tax specialists. |

|||

| Fast Filing/Delivery The fastest guaranteed turnaround online. From start to finish, your taxes are done in just 3 working days. |

|||

| Whatsapp Support Resolve queries and get support in real-time. Message us seamlessly on WhatsApp 24/7 for fast answers and effortless communication. |

|||

| Personalised Service Offering tailored advice and strategies specific to your financial situation. |

|||

| MTD (Making Tax Digital) Compliant Software Seamlessly compliant with all HMRC's (MTD) rules. We handle the digital record-keeping and submissions for you, effortlessly. |

|||

| Data Security Your financial data protection by enterprise-grade, bank-level encryption. |

|||

| Fast Refunds File fast, get paid faster. We expedite your filing to get your refund into your account in the shortest possible time. |

|||

| Highly Rated – 5-Star Google Reviews |

| Price Premium service at an unbeatable price. Expert-led tax filing and year-round support for only £130. |

£130 per annum | £350 per annum (on average) | £0 |

| In-House Dedicated Tax Specialist Get a dedicated professional who knows your financials inside and out. |

|||

| Expert Advice Personalised guidance from our experienced tax specialists. |

|||

| Fast Filing/Delivery The fastest guaranteed turnaround online. From start to finish, your taxes are done in just 3 working days. |

|||

| Whatsapp Support Resolve queries and get support in real-time. Message us seamlessly on WhatsApp 24/7 for fast answers and effortless communication. |

|||

| Personalised Service Offering tailored advice and strategies specific to your financial situation. |

|||

| MTD (Making Tax Digital) Compliant Software Seamlessly compliant with all HMRC's (MTD) rules. We handle the digital record-keeping and submissions for you, effortlessly. |

|||

| Data Security Your financial data protection by enterprise-grade, bank-level encryption. |

|||

| Fast Refunds File fast, get paid faster. We expedite your filing to get your refund into your account in the shortest possible time. |

|||

| Highly Rated – 5-Star Google Reviews |

Market Comparison

Why don’t we simply compare basics for starters

Price

Premium service at an unbeatable price. Expert-led tax filing and year-round support for only £130.

In-House Dedicated Tax Specialist

Get a dedicated professional who knows your financials inside and out.

Expert Advice

Personalised guidance from our experienced tax specialists.

Fast Filing/Delivery

The fastest guaranteed turnaround online. From start to finish, your taxes are done in just 3 working days.

WhatsApp Support

Resolve queries and get support in real-time. Message us seamlessly on WhatsApp 24/7 for fast answers and effortless communication.

Personalised Service

Offering tailored advice and strategies specific to your financial situation.

MTD (Making Tax Digital) Compliant Software

Seamlessly compliant with all HMRC's (MTD) rules. We handle the digital record-keeping and submissions for you, effortlessly.

Data Security

Your financial data protection by enterprise-grade, bank-level encryption.

Fast Refunds

File fast, get paid faster. We expedite your filing to get your refund into your account in the shortest possible time.

Highly Rated – 5-Star Google Reviews

Price

Premium service at an unbeatable price. Expert-led tax filing and year-round support for only £130.

In-House Dedicated Tax Specialist

Get a dedicated professional who knows your financials inside and out.

Expert Advice

Personalised guidance from our experienced tax specialists.

Fast Filing/Delivery

The fastest guaranteed turnaround online. From start to finish, your taxes are done in just 3 working days.

WhatsApp Support

Resolve queries and get support in real-time. Message us seamlessly on WhatsApp 24/7 for fast answers and effortless communication.

Personalised Service

Offering tailored advice and strategies specific to your financial situation.

MTD (Making Tax Digital) Compliant Software

Seamlessly compliant with all HMRC's (MTD) rules. We handle the digital record-keeping and submissions for you, effortlessly.

Data Security

Your financial data protection by enterprise-grade, bank-level encryption.

Fast Refunds

File fast, get paid faster. We expedite your filing to get your refund into your account in the shortest possible time.

Highly Rated – 5 Star Google Reviews

Your financial data protection by enterprise-grade, bank-level encryption.

Who are Taxeezy's Clients

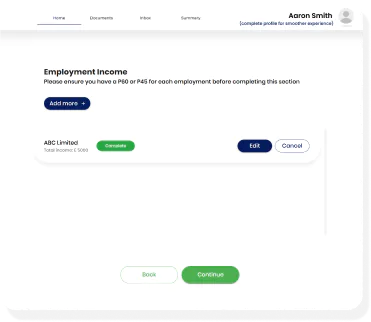

Self-employed individuals

Partnership business owners

Non-resident landlords

Company directors

C.I.S. subcontractors

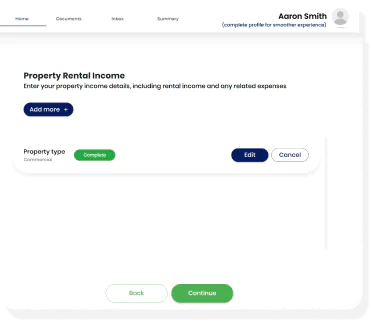

Rental property owners

Seafarers

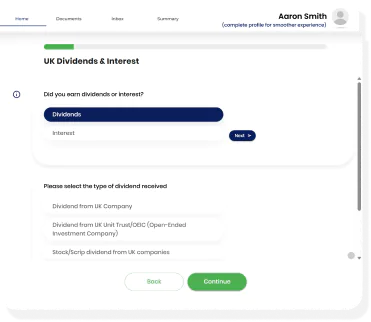

Individuals with investment portfolios

Mixed-Income Individuals

Tax Consultation

Fast. Clear. Affordable.

Get trusted, tailored guidance from our experts in a 60-minute phone or Zoom consultation — all for a fixed fee of £99. No hidden costs, just straightforward solutions.

Our Trusted Vendors